Is Hewlett Packard Enterprise Stock Outperforming the S&P 500?

/Hewlett%20Packard%20Enterprise%20Co%20San%20Jose%20campus-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $32.2 billion, Hewlett Packard Enterprise Company (HPE) is a global edge-to-cloud company that delivers solutions across Cloud Services, Compute, High Performance Computing & AI, Intelligent Edge, Software, and Storage. Its portfolio includes industry-leading servers, composable infrastructure, networking products through HPE Aruba, and consumption-based services via HPE GreenLake.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Hewlett Packard Enterprise fits this criterion perfectly. HPE serves enterprises and public sector organizations worldwide through a vast ecosystem of partners and advanced research from Hewlett Packard Labs.

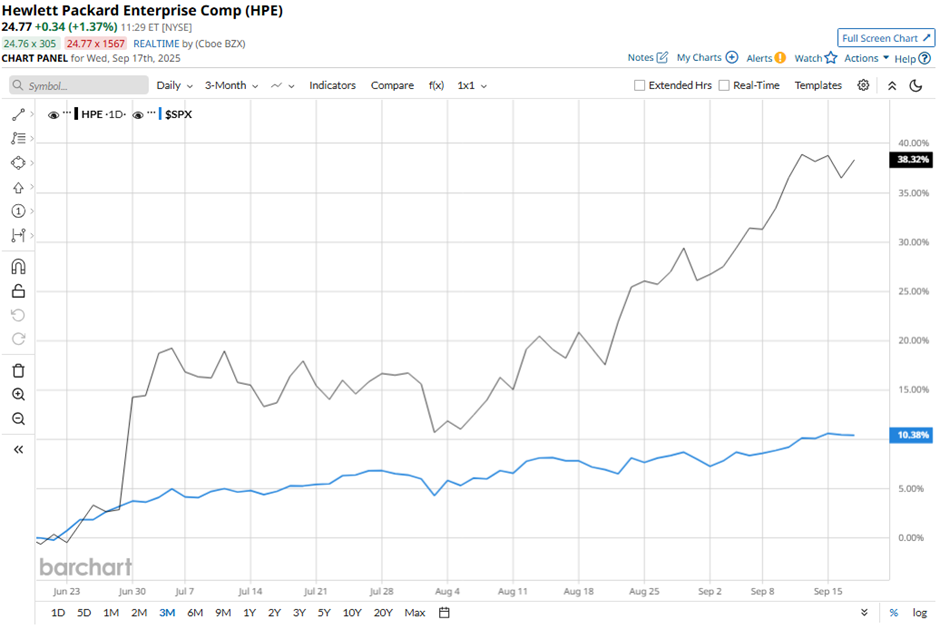

Shares of the Spring, Texas-based company have fallen 1.2% from its 52-week high of $25.10. Hewlett Packard’s shares have surged 38.6% over the past three months, outperforming the broader S&P 500 Index’s ($SPX) 10.4% gain over the same time frame.

In the longer term, HPE stock is up 16.2% on a YTD basis, outpacing SPX’s 12.2% rise. Moreover, shares of the information technology products and services provider have climbed 36.3% over the past 52 weeks, compared to the 17.2% return of the SPX over the same time frame.

The stock has been trading above its 50-day moving average since May. Also, it has remained above its 200-day moving average since late June.

Shares of Hewlett Packard Enterprise rose 1.5% after it reported Q3 2025 results that exceeded Wall Street expectations, with adjusted EPS of $0.44 and revenue of $9.14 billion. Growth was fueled by a 16% year-over-year jump in server revenue, driven by surging demand for AI-optimized servers with Nvidia GPUs, and a 54% surge in networking revenue, boosted further by the $14 billion Juniper acquisition.

HPE also raised its full-year 2025 revenue growth forecast to 14% - 16% and projected Q4 revenue of $9.7 billion - $10.1 billion, ahead of analyst expectations.

However, rival Ciena Corporation (CIEN) has outpaced HPE stock. CIEN stock has jumped 61.1% on a YTD basis and 142.1% over the past 52 weeks.

Despite the stock’s outperformance relative to the SPX, analysts remain cautiously optimistic on HPE. It has a consensus rating of “Moderate Buy” from the 19 analysts in coverage, and the mean price target of $25.13 is a premium of 1.5% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.