Should You Buy This Blue-Chip Dividend Stock at Record Highs?

The pharmaceutical sector is drawing attention again as global market revenue is expected to reach $1.21 trillion in 2025, confirming its role as a leading industry thanks to ongoing advances in treatments and growing demand for specialty drugs.

In this setting, major companies are positioning themselves carefully as investors focus more on firms that combine scale with reliable dividends. AbbVie (ABBV), with a market cap of over $320 billion, has gained more than 24% year-to-date (YTD), outperforming the broader pharmaceutical industry and delivering strong returns.

AbbVie's rise gained extra momentum last week when its shares hit a record high of $221.76 following the news that the exclusivity period for its top immunology drug, Rinvoq, has been extended until at least April 2037. This extension adds up to four more years of protection from generic competition.

Such a significant patent extension strengthens AbbVie's standing as a leader in dividend growth and increases investor confidence in the company’s future earnings. Is AbbVie's record price a good buy or a signal to be cautious at these historic highs? Let’s find out.

A Closer Look at AbbVie’s Financials

AbbVie is a global biopharmaceutical company that develops and delivers therapies across immunology, oncology, neuroscience, and aesthetics. Lately, AbbVie’s stock has steadily gained attention, rising 14.11% over the past 52 weeks and an even stronger 24.23% increase so far this year.

When it comes to valuation, AbbVie trades at a forward price-to-earnings (P/E) ratio of 18.11x, which is very close to the healthcare sector average of 18.19x, indicating that investors see its earnings potential as comparable to other companies in its industry.

The company’s latest quarterly report highlights solid performance amid changing market conditions. Second-quarter net revenues came in at $15.4 billion, up 6.6% from the same period last year. Much of this growth was driven by the immunology segment, which rose 9.5% to $7.6 billion. Within immunology, Skyrizi contributed $4.4 billion in sales, and Rinvoq added $2 billion, reflecting their growing importance in AbbVie’s portfolio.

Neuroscience products also showed strong gains, growing 24.2% to nearly $2.7 billion, thanks in part to Vraylar and Botox Therapeutic. Oncology revenues increased moderately to $1.7 billion, while the aesthetics segment saw an 8% drop to $1.3 billion, indicating softer demand in that area.

Adjusted earnings per share rose 12.1% to $2.97 despite a 32.5% decline in GAAP EPS, which was affected by expenses related to acquired in-progress research and development and milestone payments.

Unpacking AbbVie’s Growth Engines

The recent extension of Rinvoq’s exclusivity until 2037 is a key factor in AbbVie’s growth outlook. Rinvoq, the company’s second-best seller, brought in nearly $6 billion in sales in 2024, making up more than 10% of total revenue. This extension adds four more years of protection from generic competition, strengthening one of AbbVie’s main sources of income. Analysts estimate that by 2027, Rinvoq and Skyrizi, another major immunology drug, will together generate over $31 billion in sales.

In addition, AbbVie completed its acquisition of Capstan Therapeutics, gaining a promising new asset called CPTX2309. This drug uses advanced CAR-T technology to target B cell-mediated autoimmune diseases. This acquisition adds depth to AbbVie’s immunology pipeline and offers potential new revenue without some of the challenges traditional therapies face.

AbbVie is also investing $195 million to expand its active pharmaceutical ingredient manufacturing in North Chicago. This move boosts domestic production of neuroscience, immunology, and oncology medicines and shows the company’s focus on innovation and a reliable supply chain.

Together, these growth drivers support AbbVie’s strong revenue outlook and the company’s well-known dividend track record. AbbVie offers an annual dividend yield of 2.99%, close to double the healthcare sector average of 1.58%, backed by almost sixty years of dividend increases in a row. With a forward payout ratio just below 60%, the dividend remains well covered and sustainable, reflecting confidence in continued cash flow from these growth efforts.

Where Do Analysts See ABBV Heading?

AbbVie’s recent financial results and strategic moves have clearly shaped how analysts view the company. The firm has increased its 2025 adjusted diluted EPS forecast to a range between $11.88 and $12.08, up from an earlier estimate of $11.67 to $11.87. This update includes a $0.55 per share negative impact due to acquired IPR&D and milestone costs, signaling some challenges but also showing confidence in ongoing earnings growth.

This positive outlook is reflected by major players like Wells Fargo and J. P. Morgan Chase, both of which raised their price targets and maintained “Overweight” ratings. Wells Fargo lifted its target to $260 from $240, emphasizing that the extended exclusivity on Rinvoq gives the drug a “really long runway” for steady revenue.

J.P. Morgan also raised its price target, moving it from $200 to $235, projecting about an 8% upside fueled mainly by solid sales expectations for Rinvoq and other immunology drugs, helped by the recent patent extension.

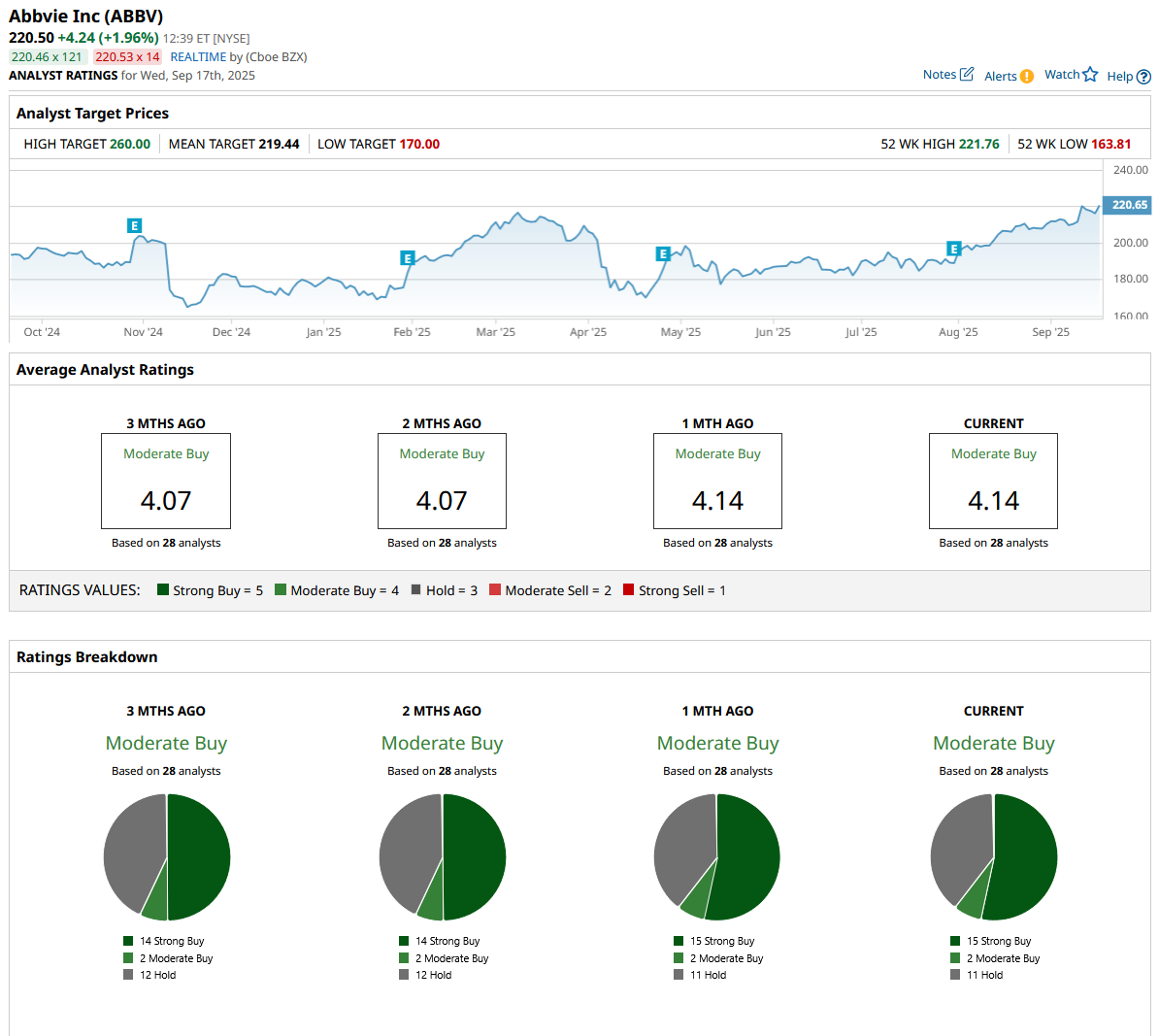

Looking at the bigger picture, all 28 surveyed analysts agree on a “Moderate Buy” rating for AbbVie. The average price target sits at $219.44. Given the current price, this indicates a tiny upside of under 1%.

AbbVie’s strong fundamentals, extended patent protection on Rinvoq, and consistent dividend track record make it a solid contender even at record highs. While the stock’s valuation leaves limited near-term upside, the company’s durable growth drivers and reliable income stream suggest shares are likely to hold their ground or inch higher over time. For investors seeking a blend of steady returns and dividend income in the pharmaceutical sector, AbbVie remains a worthy buy despite its recent price surge.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.